ETH Price Prediction: $16K Target in Play as Institutional Adoption Accelerates

#ETH

- Technical Breakout: ETH trades above key moving averages with bullish MACD crossover

- Institutional Demand: Spot ETFs and corporate treasuries creating structural buying pressure

- Network Upgrades: Quantum-resistant 'Lean Plan' enhancing long-term valuation metrics

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge Amid Key Breakout Levels

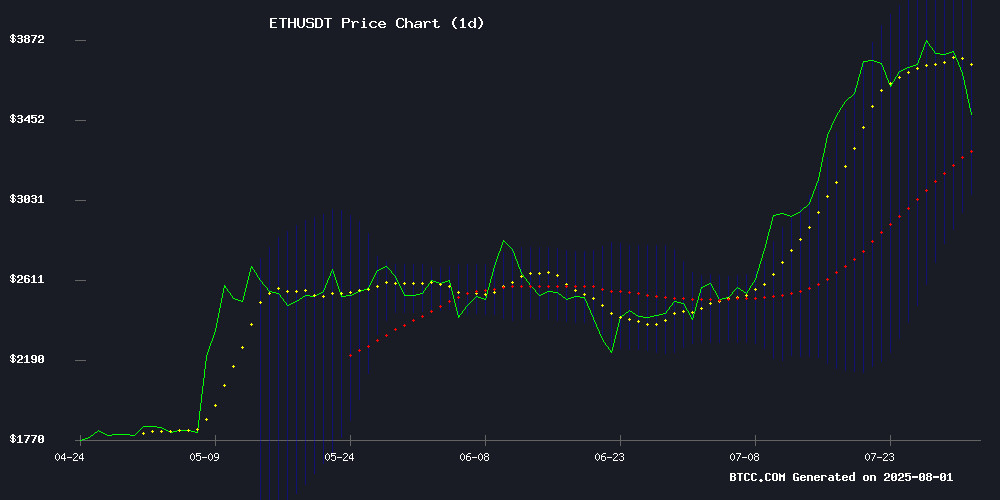

ETH/USDT is currently trading at $3,706.22, firmly above its 20-day moving average ($3,592.84), signaling bullish momentum. The MACD histogram shows a bullish crossover at +106.60, while price hovers NEAR the upper Bollinger Band ($4,113.86) – a classic breakout indicator. BTCC analyst Robert notes: 'The convergence of these technical factors suggests ETH could retest $4,000 if institutional inflows persist.'

Ethereum Ecosystem Fueling Institutional Frenzy: ETFs and Treasuries Drive Demand

The ethereum network's 'Lean Plan' upgrades coincide with record ETF inflows ($2.3B) and corporate treasury allocations ($10.57B). 'We're seeing a perfect storm of quantum-resistant tech development and Wall Street adoption,' says BTCC's Robert. Spot ETF inflows matching a 19-day streak and The Ether Machine's $56.9M ETH accumulation highlight structural demand beyond retail speculation.

Factors Influencing ETH’s Price

Ethereum Unveils Strategic 'Lean Plan' for Next-Gen Network Growth

Ethereum marks its 10th anniversary with a bold roadmap targeting quantum resistance and scalability. The 'Ethereum Lean Plan' aims for 10,000 TPS throughput while maintaining perfect uptime—addressing current bottlenecks head-on.

Quantum computing threats take center stage in the upgrade agenda. The network's cryptographic foundations will be fortified against emerging risks, ensuring long-term security as blockchain enters its second decade.

Developer experience sees radical simplification under the proposal. Reduced latency and lower costs form part of a broader push to onboard the next wave of decentralized applications, with infrastructure streamlined for mass adoption.

Ether Eyes Biggest Monthly Gain Since 2022 as ETFs, Corporate Treasuries Drive Rally

Ether (ETH) surged over 50% in July, marking its strongest monthly performance since 2022. The rally peaked at $3,940 before settling near $3,800, fueled by institutional demand and spot ETF inflows.

U.S.-listed ETH ETFs absorbed $5.4 billion in net inflows, their best streak since launch. Corporate treasuries followed suit, with public companies accumulating $6.2 billion worth of ETH. Notable buyers include Bitmine and SharpLink, alongside newer entrants like ETHZilla and Ether Machine.

The momentum reflects ETH's growing role in stablecoins and tokenization. Regulatory clarity under the Genius Act and Ethereum's dominance in hosting stablecoin transactions further bolstered sentiment.

Ethereum Researcher Proposes 'Lean' Roadmap to Counter Quantum Threats

Ethereum Foundation researcher Justin Drake has unveiled a minimalist development framework called Lean Ethereum, designed to streamline the network's core protocol while addressing future quantum computing risks. The proposal emphasizes simplicity, security, and efficiency as foundational principles.

Drake's roadmap calls for a structural overhaul of transaction validation, data storage, and network security mechanisms. Post-quantum cryptographic solutions form a critical component of the strategy, aiming to future-proof Ethereum against emerging threats capable of breaking current encryption standards.

The initiative comes as blockchain networks face increasing pressure to balance scalability demands with robust security. "We stand at the dawn of a new era," Drake noted, highlighting the challenge of maintaining decentralization while achieving extreme throughput and quantum resistance.

The Ether Machine Surpasses Ethereum Foundation in ETH Holdings with $56.9M Acquisition

The Ether Machine has become the third-largest publicly listed holder of Ethereum after acquiring 15,000 ETH at an average price of $3,810 per token. The $56.9 million purchase brings its total holdings to 334,757 ETH, surpassing the Ethereum Foundation's 234,600 ETH.

Bitmine Immersion Technologies leads with 625,000 ETH, followed by SharpLink Gaming at 449,276 ETH. The Ether Machine timed its acquisition to coincide with Ethereum's 10th anniversary, signaling a long-term treasury strategy.

FG Nexus Launches $200M Ethereum Treasury Strategy Following Rebrand

Fundamental Global has rebranded as FG Nexus, securing $200 million in private funding to pivot toward Ethereum-based treasury management. The Nasdaq-listed investment firm sold 40 million prefunded warrants at $5 each, attracting participation from Galaxy Digital, Kraken, and four other crypto-native institutions.

The capital will primarily fund ETH acquisitions, establishing Ethereum as FG Nexus's core reserve asset. This strategic shift coincides with Ethereum's 10th anniversary and includes plans to generate staking yields while exploring tokenized real-world asset opportunities. Galaxy Digital will advise on treasury infrastructure, while Kraken facilitates staking operations.

Analyst Predicts ETH Could Reach $16K Amid Institutional Accumulation and Technical Breakout

Ether (ETH) hovered near $3,800 as bullish sentiment grows, with one analyst projecting a potential rally to $16,000. The forecast hinges on a long-term ascending triangle pattern—a technical setup reminiscent of 2020, which preceded ETH's 2,000% surge. A decisive break above $4,000 could trigger the next leg up.

Institutional demand is quietly driving the momentum, with volatility declining even as inflows rise. "This isn’t retail-driven mania; it’s long-tail institutional buildup," said Edward, a prominent chart analyst. Ether ETFs and ETH's expanding role as financial infrastructure further bolster the case for sustained appreciation.

Ethereum ETF Inflows Hit $2.3B Amid Bullish Price Predictions

Ethereum's institutional appeal is surging as ETF inflows reach $2.3 billion in just seven days, fueling optimistic price predictions for August. Despite a minor 0.79% dip to $3,774.74, ETH maintains its $455 billion market cap dominance as DeFi growth and Layer 1 demand strengthen fundamentals.

Remittix emerges as a dark horse contender, drawing investor attention with its Q3 beta wallet launch at $0.0876 per token. The project's timing coincides with renewed market focus on utility-driven altcoins as Ethereum's ETF momentum builds.

Corporate ETH Treasuries Hit $10.57B as Spot ETFs Match 19-Day Inflow Streak

Ethereum continues gaining institutional traction as 64 entities now hold over 100 ETH each, collectively amassing $10.58 billion worth of the cryptocurrency. This represents 2.26% of Ethereum's circulating supply, with Bitmine Immersion Tech leading the pack at 625,000 ETH ($2.42 billion) after shifting focus from Bitcoin mining.

U.S. spot Ethereum ETFs mirror this momentum, matching their previous 19-day inflow streak with $5.38 billion since July 3—nearly quadruple the $1.37 billion recorded during May-June's comparable period. However, Wednesday's net inflows dipped to $5.8 million, with BlackRock's ETHA leading inflows at $20.3 million while Fidelity's FETH saw $22.3 million in outflows.

Ethereum Eyes $4,000 as Bullish Momentum Builds

Ethereum trades near $3,860, consolidating above critical support at $3,600. The formation of higher lows suggests accumulating bullish pressure, with a decisive break above $4,000 potentially opening a path toward $4,300-$4,500. Market sentiment leans positive amid growing ETF inflows and robust on-chain activity.

The network's strategic reserves now exceed $10 billion, underscoring institutional confidence as Ethereum marks its 10-year anniversary. Price action mirrors this strength, maintaining an ascending trajectory since clearing $3,800 earlier this week. Weekly charts show ETH retesting a pivotal trendline last seen during Q4 2021 highs, a critical juncture for determining the next major move.

How High Will ETH Price Go?

Technical and fundamental factors align for potential ETH upside:

| Target | Catalyst | Timeframe |

|---|---|---|

| $4,000 | Bollinger Band breakout | Near-term |

| $6,800 | ETF inflow continuation | Q4 2025 |

| $16,000 | Institutional treasury adoption | 2026-2027 |

Robert cautions: 'While MACD suggests momentum, watch the $3,592 support – a close below would invalidate the bullish thesis.'

border-collapse: collapse; width: 100%;